Everything posted by Cecil Lee

-

Knowledge is Power? True/False?

-

Heron Bay EC - Is Heron Bay EC still lucky for the next 20 years from 2024 till 2043? Find out, here

There are many factors involved. For example, the concept of "one man's meat is another man's poison applies". The apartment may be suitable to breadwinner A. But may not be as suitable or even unsuitable to breadwinner B. Just take a look at the three attachments. Besides this, other factors including plotting the Flying Stars etc.... Therefore, just saying 55 stack 9 good buy or not is relative. It may be a good buy to person A. But may not be AS suitable to B.

-

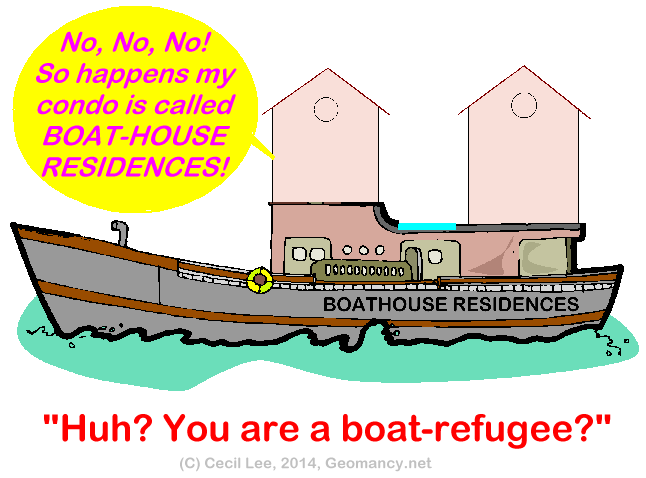

Any implications for naming: Boathouse Residences

Does it matter what a place is called? Did you arrive on a refugee-ship? So what is this Boathouse Residences about?

- Heron Bay EC - Is Heron Bay EC still lucky for the next 20 years from 2024 till 2043? Find out, here

- Heron Bay EC - Is Heron Bay EC still lucky for the next 20 years from 2024 till 2043? Find out, here

-

Heron Bay EC - Is Heron Bay EC still lucky for the next 20 years from 2024 till 2043? Find out, here

The layout of the Tower blocks in Heron Bay suggests the "porcupine effect" where in some instances, stacks MAY have sharp corners aimed towards a neighbouring stack....

-

Heron Bay EC - Is Heron Bay EC still lucky for the next 20 years from 2024 till 2043? Find out, here

No offence, the name remindes me of ...http://forum.geomancy.net/phpforum/article.php?bid=2&fid=29&mid=31903&new=%3EHouse%20Hunting%20:%20A%20Lot%20Position%20-%20%3Cem%3EFeng%20Shui%3C/em Based on Shapes and Forms Feng Shui and Flying Stars, stack #05 seems to be the best stack as it is NE facing. Stack #08 is the next best stack provided or hopefully, a unit is partially blocked by it's neighbouring blocks from the Boat House. Ain't it a no brainer that even without Feng Shui; stack #05 (and #08 = subject to further comments below) seems central and the most distinctive in this entire block? It is not very often that Shapes and Forms and common sense share the same consensus! What can I say! And both are one of the biggest + #05 dual key.. unique ... ones... OOps! This development has several PORCUPINES.... Erh... what about the rest? Did you notice that the corner of stack #20 is aimed towards #08? Or stack #19 aimed towards #23 and stack #06 also aimed towards #23? In general, I quite like this plot of land given that it considered as at the highest "upstream" of Upper Serangoon Road; and there should not be any more developments to it's North other than perhaps greenery + some low rise park-activities kiosks (if any). In addition, it's plot is rectangular as opposed to it's neighbour : what a name "Boathouse".

-

Beware of this Age Old Traditional Feng Shui Scam

-

Lovesigns.net: A Horse vs a rat? How favourable?

-

Beware of this Age Old Traditional Feng Shui Scam

-

Neighbour's cactus plant in front of our house

If one does not want to place one of those conVEX mirrors; then this (stealth-mode) is a possibility:- http://forum.geomancy.net/phpforum/article.php?bid=2&fid=1&mid=16004&new= Other past resources:- http://forum.geomancy.net/phpforum/article.php?bid=2&fid=1&mid=27978&new= http://forum.geomancy.net/phpforum/article.php?bid=2&fid=1&mid=23368&new= Please note that the "mirror" need not be exactly facing the cactus. So long as it shares the same concept of a convex mirror above the door or as mentioned in the first link is fine or OK.

-

Neighbour's cactus plant in front of our house

Further to what I had mentioned; There are two other alternatives: 1. If one wants to apply "stealth" or stealth mode, is the use of highly reflective grille gates e.g. chrome or a reflective mirror on the gate. 2. The other is the traditional method of placing a convex mirror above the door.

-

Neighbour's cactus plant in front of our house

These are some considerations: 1. Fortunately, for now, the cactus is just a "stump" and does not seem to have torns (correct me if I am wrong). This is a plus point. 1.1 If the cactus is tall and lots of "branches" then, it is a concern. 2. Under the Five elements concept, fire or something RED can be used against it: Not possible to move your plant to the same side of the cactus? (If so, understand as the area "belongs" to your neighbour" or your main door is in the way should you place it to the right of the main door. 3. For now, just monitor the situation i.e. hopefully the cactus does not grow tall with lots of branches.

-

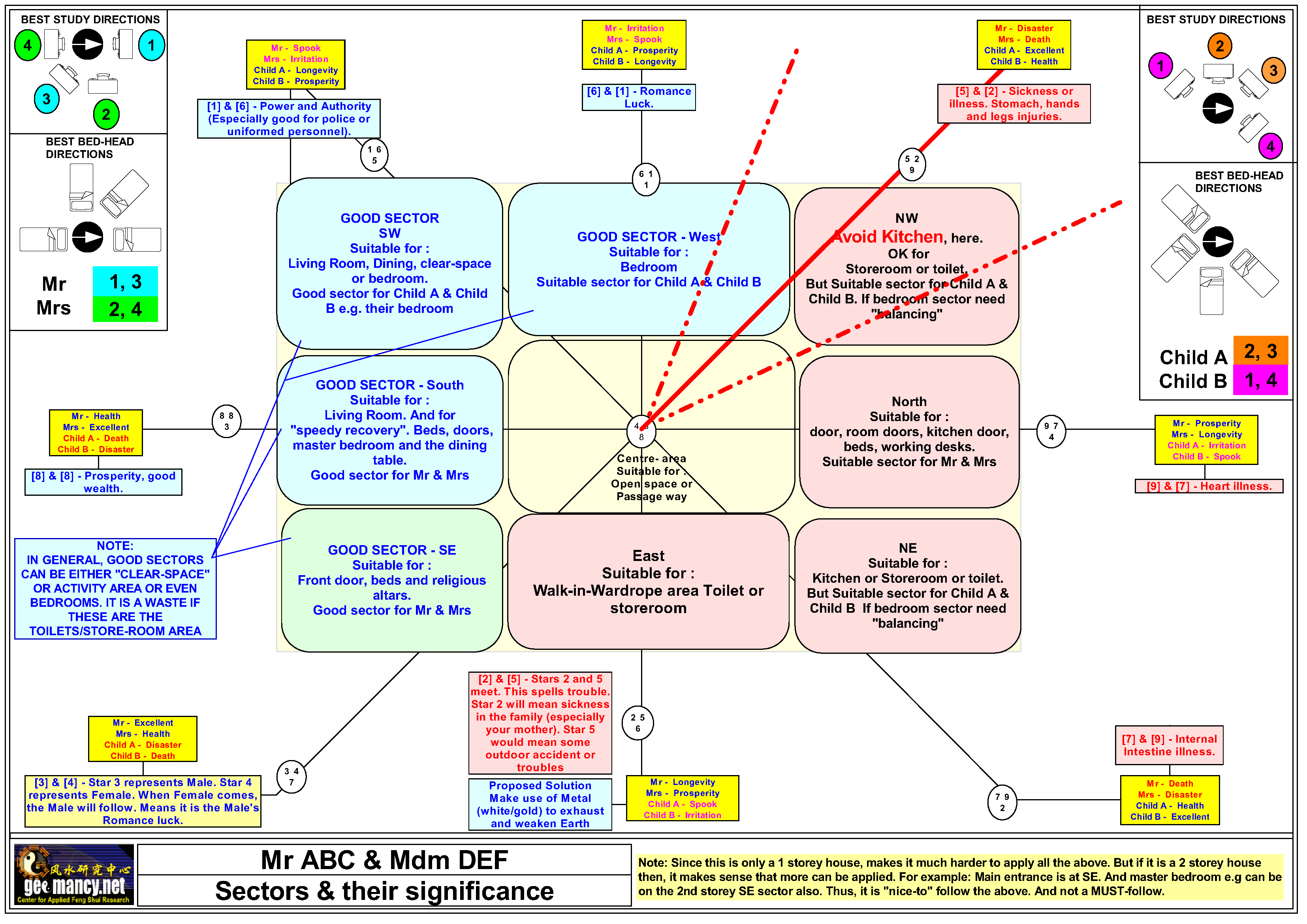

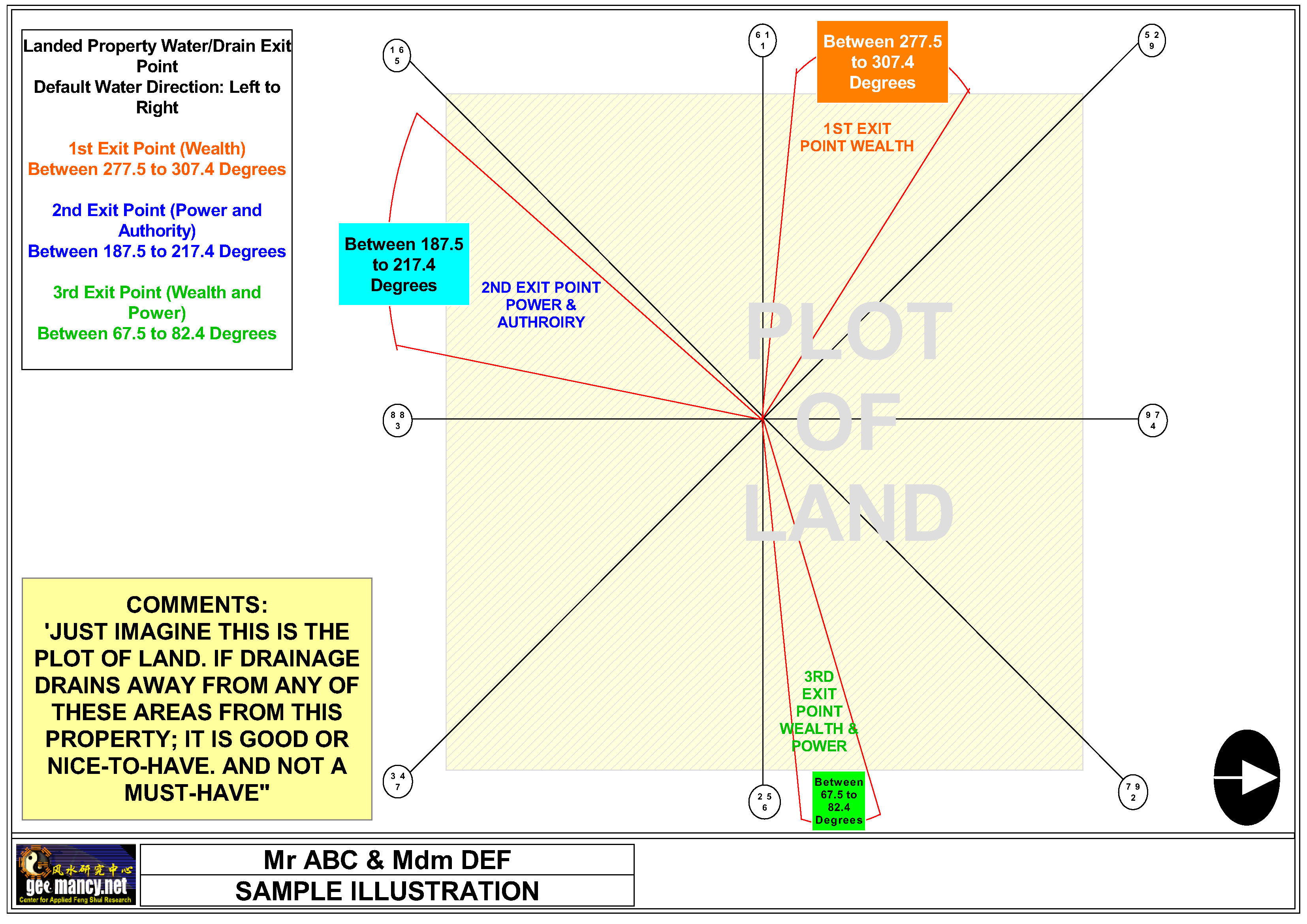

Constructing a new residence from the ground up.

Begin by mapping out the Nine sectors and determining the most suitable purposes for each. This analysis should also consider the optimal drainage system for the property.

-

What's in a square, circle & triangle?

Under the Five Elements Concept (Wu Xing) in Chinese metaphysics and Feng Shui, each element is associated with a specific shape: - Earth: Square or rectangle - Metal: Circle - Fire: Triangle For completeness, here are the other two elements and their shapes: - Wood: Rectangle or column (sometimes elongated shapes) - Water: Wavy or curved shapes These shapes are often employed in Feng Shui design, interior decoration, architecture, and symbolism to balance or enhance specific element energies in a space.

-

Blame it on?

-

Rejected, rejected and rejected AGAIN!

-

Tell-tale signs of a just T.O.P. condo apartment

Can you spot the tell-tale signs of a just T.O.P. condo unit besides empty units? Please look at these photos... carefully

-

Clothes-line bamboo poles = poison arrows?

Seemingly innocent bamboo poles - if aimed towards a home's main entrance (or openings such as an open window) is considered a "poison arrow" or Sha Qi.

-

The dangers of auto-suggestion & self-fulfilling..

What is auto-suggestion & self-fulfilling prophecy about? It is said that if one were to scold a sheep or a cow = stupid; this will not lead to auto-suggestion. But if one were to scold a child : stupid, stupid, stupid! The child may end-up being stu-pig!

-

Beware of this Age Old Traditional Feng Shui Scam

-

Singapore the most expensive

-

Singapore the most expensive

-

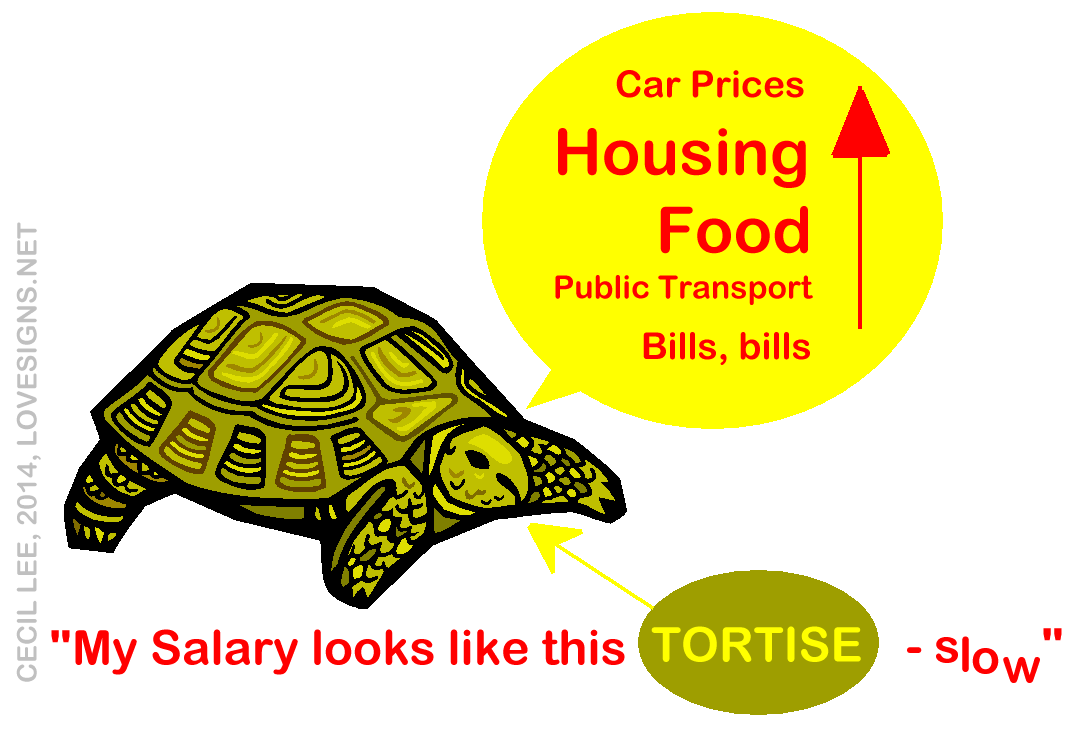

Determining the frontage of an apartment

This frontage @ The Canopy is equally dim. It may not totally dim due to the quality of the Iphone5 lens..

-

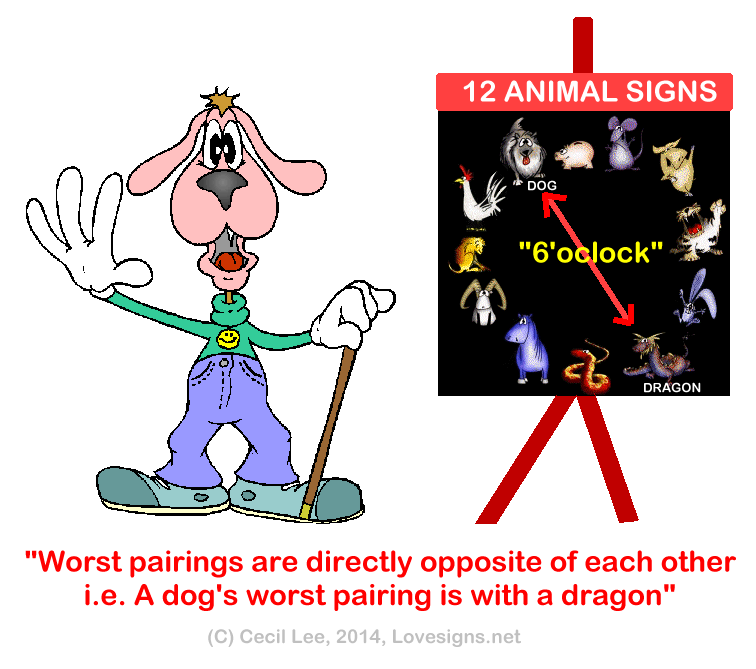

How compatible are a Dog with a Dragon?

The Chinese Zodiac consists of 12 animal signs. And every 6 hours (erh... I mean 6 years) an animal sign will be directly opposite each other.... and this pairing is considered is worst amongst themselves... For example, in this illustration; a Dog has at least 6 years difference in age with a Dragon. And they are directly opposite each other..... thus considered the worst pairing. Same for a Rat with a Horse...

.png.396ab176400b8a86adbe21aab8cdb701.png)

.jpg.9b2ce908d1391c73832105de31c0ce98.jpg)

.png.b955bf486ed89e745c0bb9d21644f310.png)