-

Posts

36612 -

Joined

-

Last visited

-

Days Won

136

Content Type

Profiles

Forums

Blogs

Events

Gallery

Store

Articles

Everything posted by Cecil Lee

-

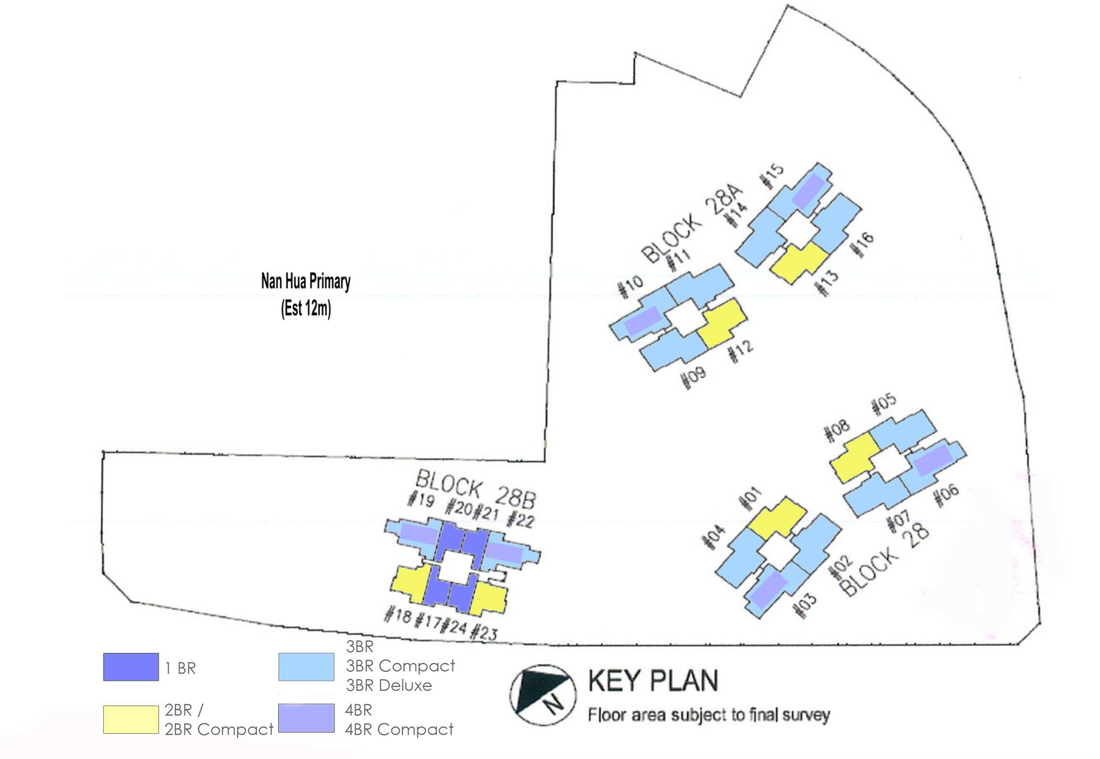

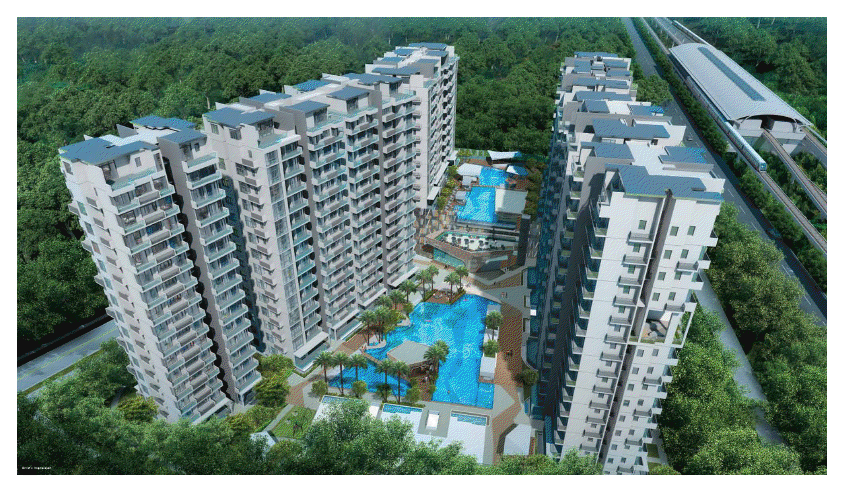

Urban Vista Condominium ismid-sized @ Tanah Merah Kechil Road, Singapore 465504 Developer: Bayfront Realty Pte Ltd (Frangance Group and World Class Land) Tenure of Land: 99 Years Residential (Condominium) Total nett site area: 13,998.5 sqm / 150,680 sq ft Site Area: 13,998.5 sqm or 150,679.85 sqft Total units available: 582 (11 blocks of 15th Storey) Bedroom Size: 1/ 2/ 3/ 4 /2, 3 ,4 Bed Dual Key /Penthouse

-

The Fortredale which was newer than many of the developments had enbloc and sold has sold for around $65 million. Thank God for it. As for liveability; it each unit looks more like a fish aquarium when one walks past it during both day and night! However, somehow, in it's place The Line, even with it's enticing lucky draw of a BMW 3 series vehicle ... seems in my opinion to suffer from poor sales... (where each unit is sold roughly at 2,xxx per sq feet.

-

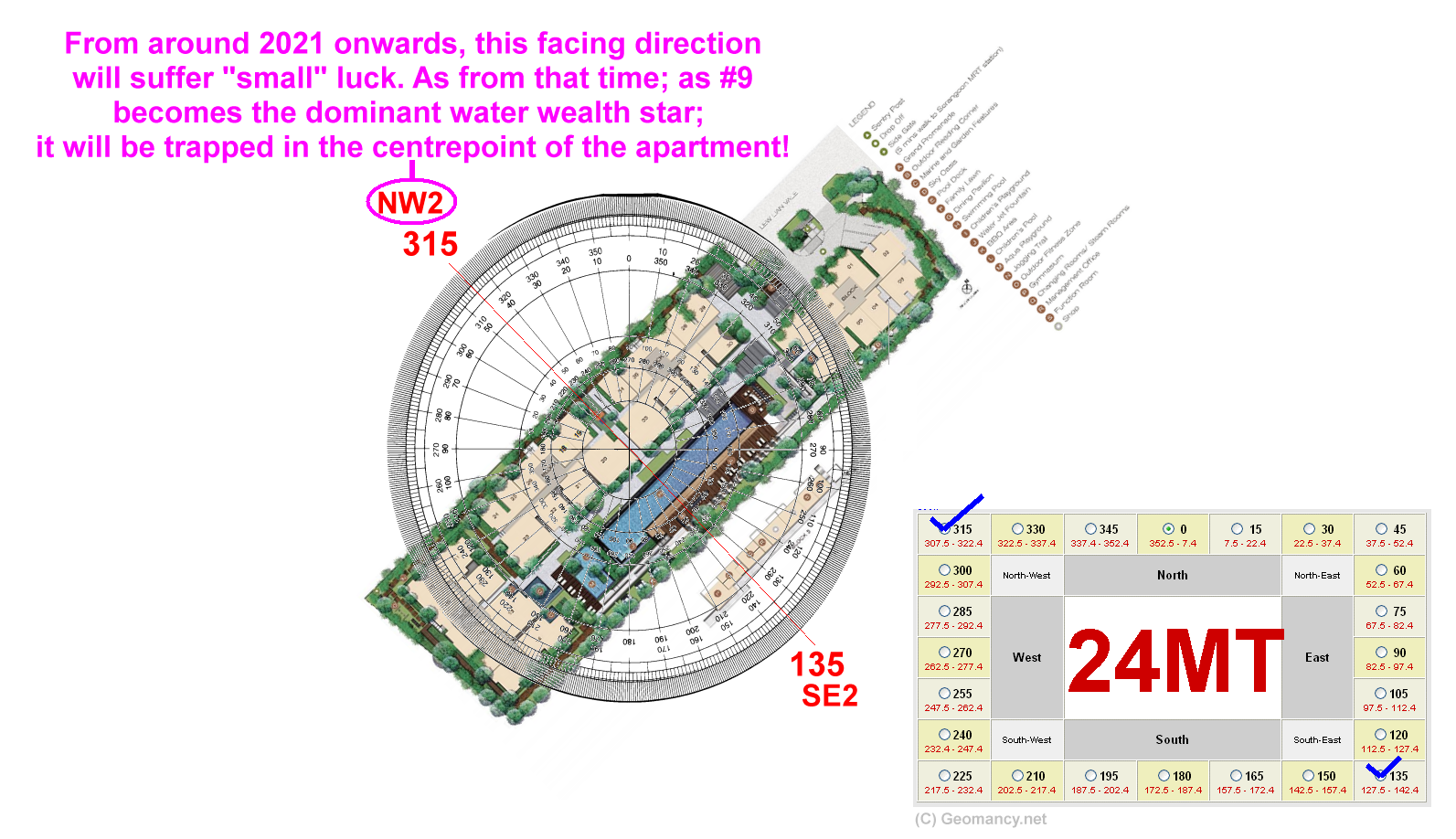

Jade Residences is asmall low-rise residential condo development of 170 units. Location : 2 & 4 Liew Lian Vale, Singapore 537013 Developer : Roxy Pacific Holding Limited Tenure : Freehold District : D 19 Jade Residences comprises of two blocks: 2 and 4. Majority of the stacks/units face either pure NW2 or SE2. For stacks/units facing NW2; it has the current prosperity water wealth at the frontage and the current networking and relationship (mountain) luck at it's back. Which is considered favourable. However, other sectors don't really have good star numbers. May need to be disarmed. One bad news is that if one intend for stay and will actually be staying put in this apartment. Then between 2021 to 2024; when the wealth stars change to #9; many of the residents would suffer "poor luck" as at that time, the dominant water wealth star is trapped in the centrepoint of the apartment. Here, this is known as "small or little" luck. Historically, I could remember clearly, it was the year 2002 (a few years) before the change of qi to Period 8; suddenly during 2002 and2003; I would receive more than the fair share of requests for a Feng Shui audit. Automatically, I would ask: Is your home facing NW or North? And when I go into details; many of such homes at that time that had a water star #8 (current prosperity) trapped in thecentrepoint of the home; the owners particularly the male would say that suddenly they met with lots of obstacles and problems...

-

These are some considerations:- 1. You wrote: Is it true? 1.1 Yes, if you are strictly applying the Gua or Eight House; 1.2 It can be classified into: 1.3 The direction / Location significance / Status (good or bad) and even suitable for what purpose (if any). 2. Attached please find a sample illustration of a random Gua number and it's associations. 3. The rest of the questions are beyond this forum. 4. You also wrote: "Kindly advise asap as we are going to view this coming Sunday...." 4.1 It is good to remind ourselves that if we do have a time constraint; spare a thought for others. As they also have time constraints. Courtesy begets Courtesy especially incessant sms messages, one after another even till late in the evening without due regard to check if others are busy or not.

-

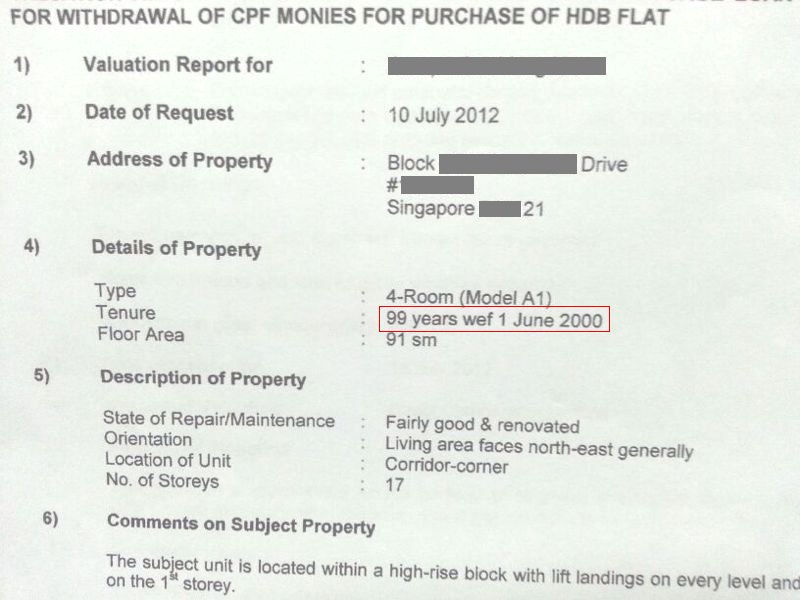

We humans each have a birthdate. Likewise, under Flying Star Feng Shui, one must also ascertain the "birthdate" of the house. On the first page of all HDB valuation report(s) would list down the date the lease started on a specific flat. Under Para 4) Details of Property: Tenure: 99 years wef from 1 Jun 2000. (This example)

-

Please take note that for this development, especially if one is considering a South facing e.g. Flying Star South 2 (S2) facing; some stacks in this development has it's kitchen at the inauspicious "Fire at Heaven's gate sector" i.e. NW. (And in some instances, major missing corners - if any). Specific examples will be released at a much later date so as not to disadvantage clients that are eyeing this development.

-

At Bartley Ridge Condo; the 3 bedroom(s) layout has the toilet bowl sharing the same wall as the kitchen stove. This is considered inauspicious in Feng Shui. For any apartments (flats) there is no possibility of ever shifting the toilet bowl. But still possible; yet, quite a hassle and it costs money (and what a waste) for a brand new kitchen. If possible, avoid purchasing a unit with such a configuration. See attached illustration.

-

These are some comments: 1. Majority of the stacks either face Flying Star Period 8: N3 @ 20 degrees or S3 @ 200 degrees. 2. N3 falls within 7.5 to 22.4 degrees. While S3 falls within 187.5 to 202.4 degrees. 2.1. Herein lies the danger that if somehow, all the blocks and stacks are wrong or different from the siteplan; and if the variance is just 2.4 degrees; 2.2. All the blocks and stacks may inadvertently fall within the "No man's land". As it may either be neither N3 or NE1 and/or S3 or SW1. If so, good luck to those staying within the development. 3. Under Shapes and Forms Feng Shui, such "jagged" stacks would often result in the "porcupine" effect where the corners of various stacks may become sharp corners and become sha qi or poison arrow(s) towards each other. Please see one of the attachments. 4. Stack #44. This is not Feng Shui. But many Cantonese don't like "4" = die. Here stack #44 means "die-die". This often affects it's future resale value. (Not so much of Feng Shui.) 5. Personally, I don't really like the location: Mount Vernon Road. Perhaps, I am bias; but the memories of cremation (or human cremation that was in the not so distant past) still fresh in my mind. Whenever the words "Mount Vernon" is mentioned or surfaces in the site plan. Please note that this is a personal bias (only).

-

-

-

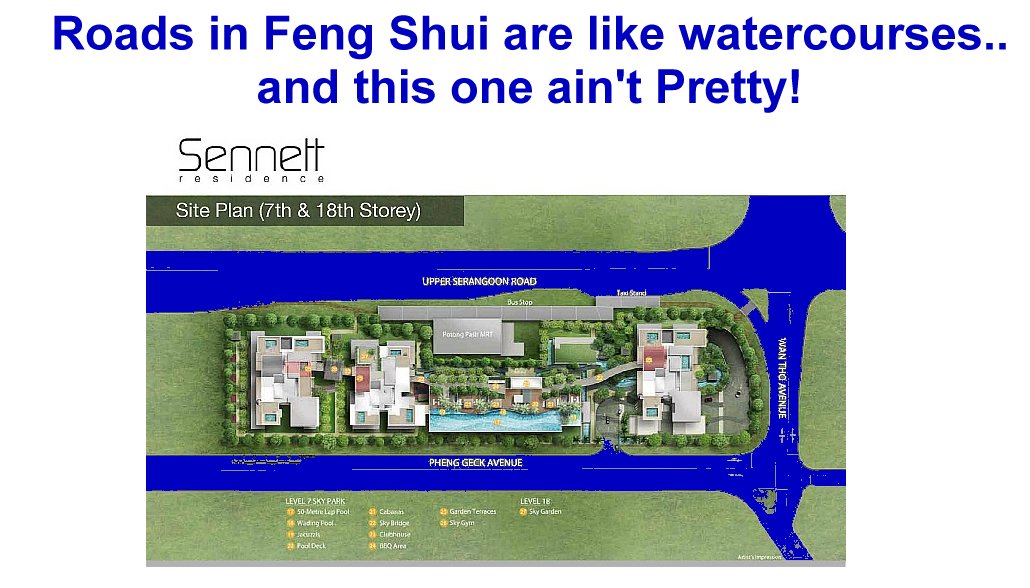

Sites with roads all round it (here, 3 sides) are considered malignant. Fortunes will wane widely in such a development..... a site that does not have good or "solid backing" ain't a good site... rather risky...

-

In general, based on Shapes and Forms Feng Shui; ideally a plot of land especially for a home should not be surrounded by roads. For this site: Sennett Residence; this plot is surrounded by three sides (roads): Upper Serangoon Road Pheng Geck Avenue and Wan Tho Avenue The above is a minus not a plus point for this development. And does not bode well for good overall Feng Shui. For those who are interested in buying a unit there should exercise greater caution. More: 99 Years Leashold with effect from 11 Aug 2011 Developer Clerodendrum Land Pte Ltd (Tuan Sing Holding Ltd) City Fringe in District 13 Land Size about : 93,000 sqft (Oops! Surrounded by three roads) 3 blocks of 19 storey high and 1 block of 5 storey high building 332 Residential Untis and 3 Commercial Shops Allocated Parking : 284 lots (inclusive of 3 handicap lots) Expected TOP about Mid-2017 No Bay Windows/Planter Box or Home Shelters Next to Potong Pasir MRT (North-East Line)

-

Most homes in general fall between a hidden gem vs a rotten apple... To assess this; and in Feng Shui, a triage is required to find out the home's rating: Good, the bad, the average or the "ugly"...

-

1. Frankly, The science of Feng Shui is like any other discipline. It requires a properhttp://wiki.geomancy.net/wiki/Feng_Shui_Triageto be done. 2. Only after doing a proper Triage can one find out whether a home (or your home) is an unpolished gem or a true rotten apple or somewhere in between. 3. For example; if a home is like an unpolished gem; some enhancements can bring great (good) results. 3.1 Most homes are usually between these two: and after considering the science of Feng Shui; if one (via the Art of Feng Shui) properly enhance + neutralize bad Qi; often one can see good results. 4. However, or unfortunately; some homes are like a 10 year old 1,000cc car. No matter how much enhancements or Elastoplast (fix leaks) ; does not help. 5. But do be wary of seeking help: if any from geomancers that too often push or sell lots of commercial products in the name of Feng Shui. Often, even if a cure is needed; the items can easily be found at home or are not very expensive. 6. In conclusion, even if we need to consult a doctor: internal medicine doctors will also ask a person to go for tests like blood testing; ultrascan of kidneys; MRI's etc. Only after such tests are done; can a Dr. Then prescribe some form of remedy or preventive medicine. 7. Thus, please note that if you are trying to approach it from a Feng Shui point of view; if no triage; might as well throw a dice or flip a coin! 8. There are no short cuts nor a posting of a few sentences, to uncover the problem(s) or advice on a solution if any.

-

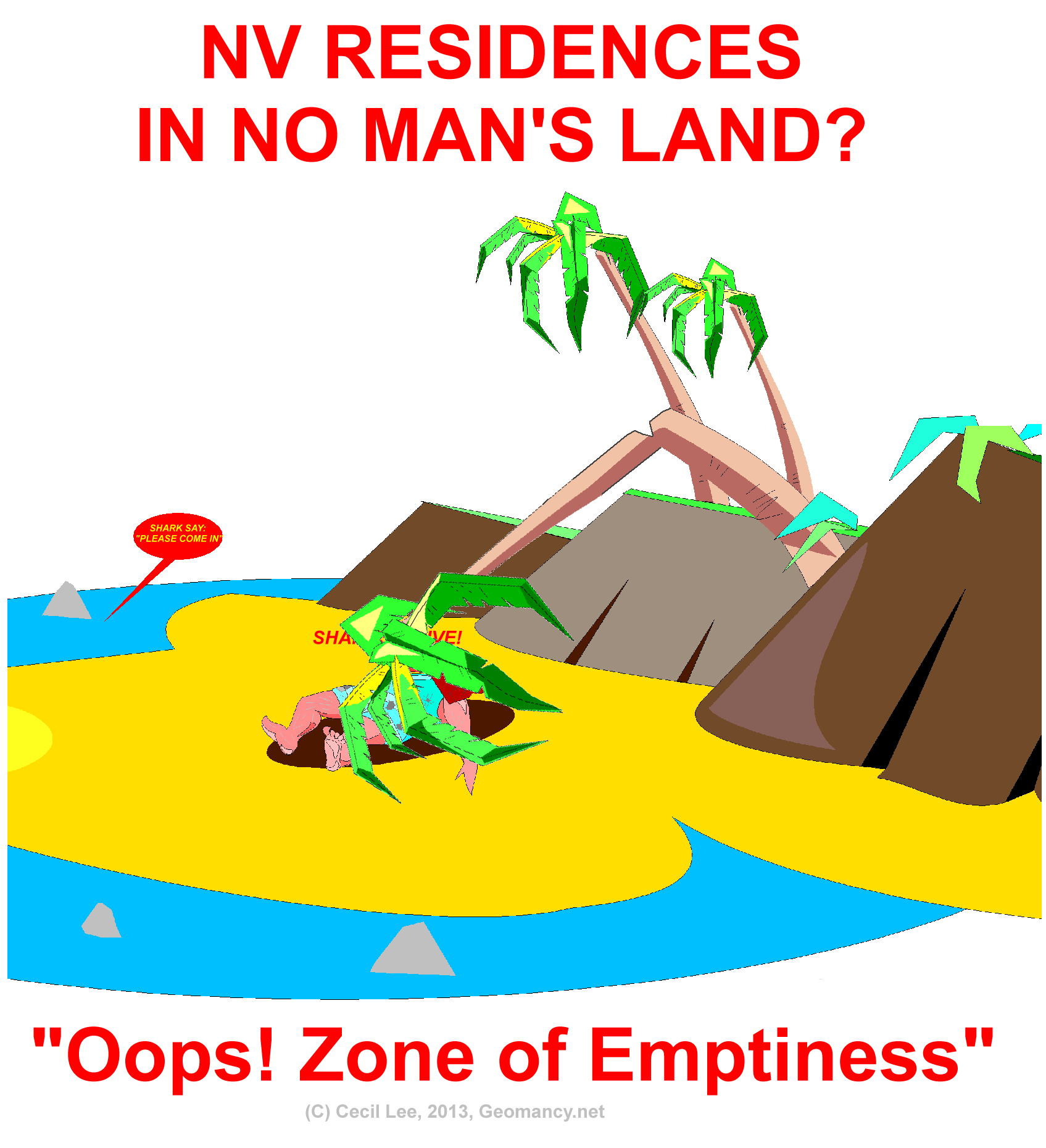

It's too late! NV Residences is nearing completion. And already cast in stone! Hopefully, many of the stacks fall exactly under Period 8 : N3 or S3! Anyway... if you don't stay there or not going to... no worries.... it does not affect YOU!

-

NV Residences consists of 8 Blocks. Majority of all the Eight Blocks are aligned in the same direction. However, based on the Sales brochure site map and the one available at streetdirectory.com; It seems that the facing directions of most of the stacks either face N3 or exactly 22 degrees or S3 or 202 degrees. Just a .4 of a degree would bring all the stacks closer to what is called a "zone of emptiness". Here, it would mean that majority of the stacks either face: "neither N3 or S3" but in a very inauspicious zone between these two Flying star directions. And vice versa for those stacks that "neither face S3 or SW1. In Flying Star Feng Shui, if the developer and their contractors were to built the development as neither "HERE nor THERE" = very inauspicious. Let's hope that it is a close call or close margin! As there are a total of 8 blocks; I would have to pay more attention when taking readings for clients at each individual block. Thus, there can be a possibility that a client staying in say Blk 91 would heave a sigh of relief while another at Blk 93 or 99 may be affected by this "zone of emptiness"

-

No point having nice facilities if: in Flying Star Feng Shui: one may fall into a "zone of emptiness". Let's hope not for all the residents x 8 blocks in this development NV Residences.

-

-

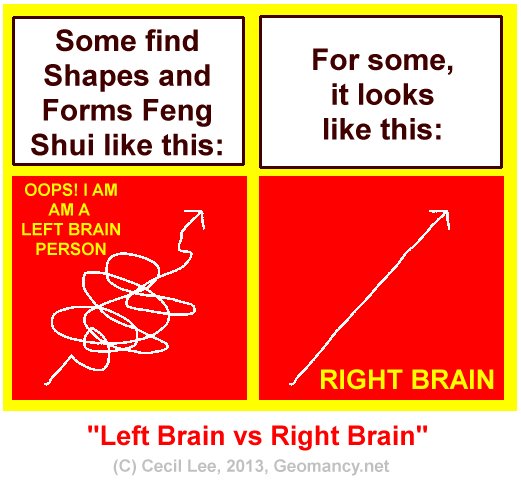

Feng Shui comprises two major schools: 1. Shapes and Forms Feng Shui 2. Compass School Feng Shui Do you know that Shapes and Forms Feng Shui appeals more to those who are more of a Right Brain person. Under the Left and Right Brain Theory, those who are more of a right brain inclined person are best at spatial and better at expressive and creative tasks. And more likely to "pick" up easier on Shapes and Forms Feng Shui. For example, a person who is more into the "arts" would be better off at studying History, Literature, Law, Commerce. And if enrolled in an ivy league school could go to Harvard. While a person who is more "mathematical inclined" would fit better with courses in Maths, Chemistry and Physics and more at home in MIT. Thus, those who feel right at home with Compass School of Feng Shui are usually more Left Brain inclined person.

-

Qbay Residences Condo - Which units are lucky?

Cecil Lee posted a topic in Singapore Property Review

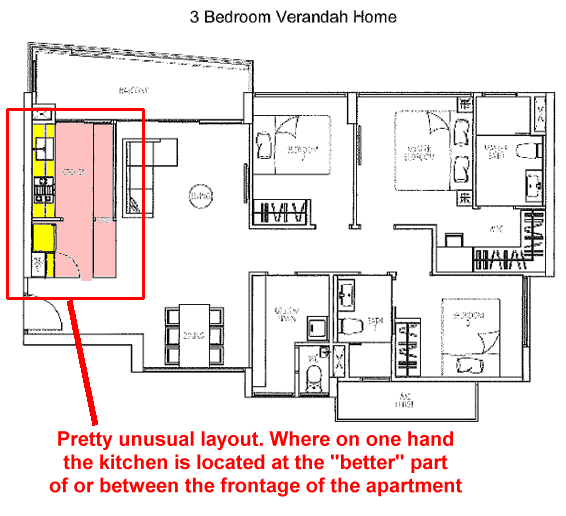

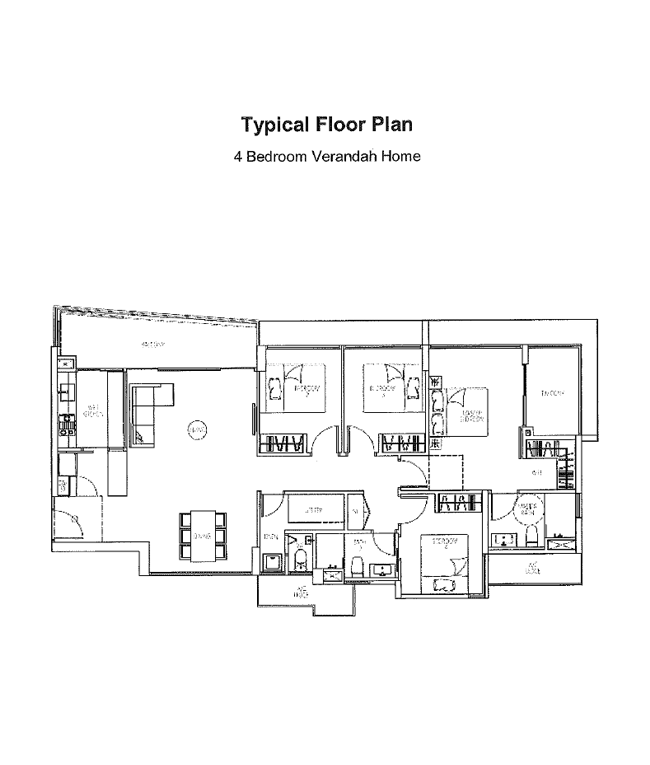

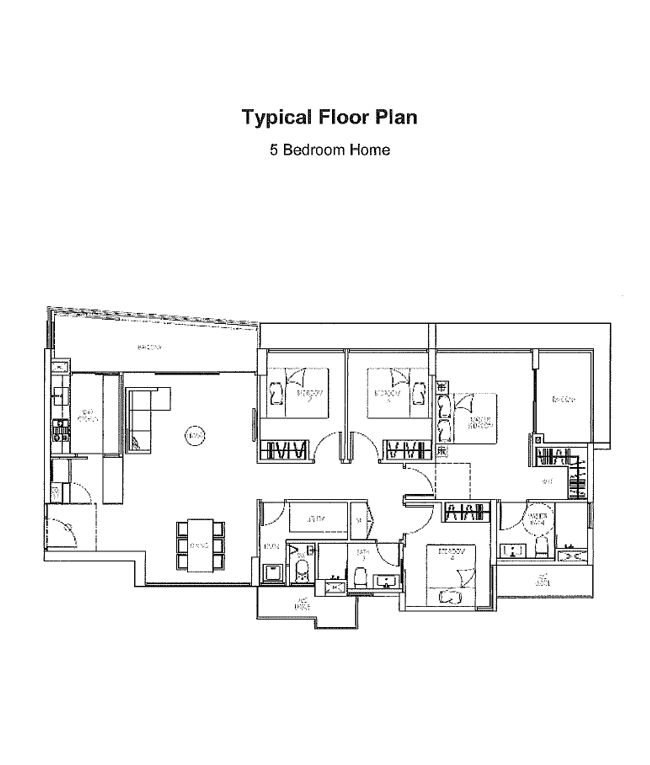

The 3 Bedroom Verandah & similar layout plans This is the first time I had come across interior layout plans where the kitchen shares the living room balcony. Luckily, there is no interior waste disposal bin. Else, it may have to be located at the kitchen area which is near to the frontage of the apartment. I believe it also encourages home owners to hang or display their clothings for drying at the balcony or verandah. Which by right is considered a no-no for most condo developments. As it is considered that such anti-social behaviours may degrade or lower the value of that condo. Maybe this condo is exempt from it?

Forecast

Free Reports

Useful Handbooks Guides

Feng Shui

- Feng Shui Resources

- Fun with Feng Shui

- Photo & Pictures

- Encylopedia of Feng Shui

- Singapore Property Review

Chinese Horoscope

Palmistry

Feng Shui Consultation

Services

Order & Download Forms

Main Navigation

Search

.gif.0143b216aa2cdcf3d0531cc374ff5ec7.gif)